Brian

5 Stars ⭐️⭐️⭐️⭐️⭐️

Want to know how to insulate windows? Indow inserts are an easy, immediate, reversible solution to: cold drafts, noise, hot summer air, and fading hardwood floors. Indow uses precise laser measurements to create custom inserts.

Every insert fits your window precisely – even if your window is odd-shaped. We use durable acrylic panels, which insulate better than glass, surrounded by compression tubing so inserts fit snugly in place. This combination is the best way to insulate windows. Indow inserts don’t just insulate against drafts and noise. You can choose privacy or UV protection. Look through our solutions below to find the best window inserts for your needs.

The best way to insulate windows against cold, summer heat, and save on energy bills.These inserts seal out drafts, insulating windows against cold while providing some noise reduction.

Our acoustic panels insulate against drafts and have increased noise reduction abilities. These inserts are insulating windows against outside noise to create a quiet, more soundproof environment.

In addition to insulating windows, our these inserts obscure light for privacy, block UV light for protection, or completely blackout a room for a dark, quiet sleep environment.

All custom-made Indow inserts are great at insulating windows against drafts and noise. Different grades have additional insulating powers. See all our grade types to find the best window inserts for your situation.

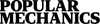

Each insert has a tube that edges the clear acrylic. This tubing should blend into your window frame. It comes in three colors: white, brown, and black.

All our acrylic interior storm windows are durable, lightweight and made to blend seamlessly with the surrounding frame. Don't buy new windows. Make the ones you have just right with our precision measuring software, which will ensure a tight fit for your new window inserts. Just choose the grade you need and get started measuring. We're here to help at every step.

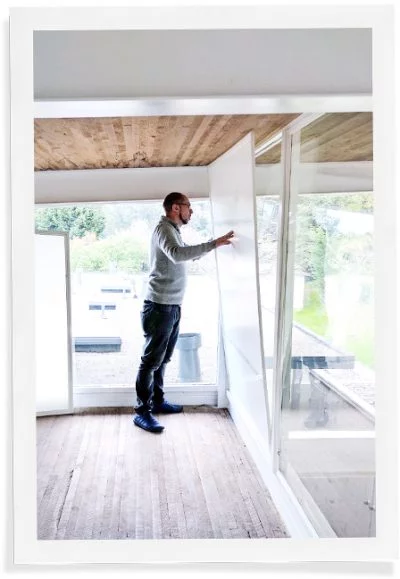

Indow window insulation inserts are custom made to fit your window perfecty. When they arrive, all you have to do is press them in to place to start insulating your windows. Our window inserts install in minutes with no mounting hardware. And depending on their size, you only need one person to put them in place.

All of this means saving money from lowered energy costs. By insulating windows with our inserts, you also preserve your existing windows. The inserts press inside your window frame with no construction needed, ready to insulate immediately.

Indow has insulated more than 23,000 buildings - helping reduce carbon emissions by nearly 200,000 tons - and creating comfort across the US & Canada!

Request a Free Estimate. We'll provide you with a preliminary estimate based on your basic window dimensions. It's quick and easy!

Measure your windows with our easy-to-use laser measurement kit. We'll guide you through the simple process, ensuring a perfect fit.

Customize your inserts to match your needs and your aesthetic, with tubing colors that seamlessly blend into your space.

Transform your space with custom-crafted inserts shipped directly to your home, ready to fit perfectly in your windows.

You're one step closer to creating more comfort & quiet in your home.

To receive a customized estimate for your space or learn more about how Indow inserts can improve the comfort, quiet, & efficiency of your home, fill out the fields below.

We value safety and privacy. We will never share, sell, or rent your data to third parties not directly related to your purchase or consideration of our products. Read our full policy here.

These windows are great! They have improved the quality of our home with reduced thermal loss and reduced noise level! The temperature today is 93° outside, our split system is set at 73° and the inside house temperature is 74°! Before the install of these windows the inside temperature with these conditions would have been 76°! Last night I noticed an ambulance going by. Normally the first thing I recognize is the noise, but last night I didn't realize it was an ambulance until I saw the flashing light! Hannah did a wonderful job coordinating the measurements and the sale! I would recommend these windows to anyone!