Terry W

5 Stars ⭐️⭐️⭐️⭐️⭐️

2025 is the last year to take advantage of the IRA tax credit!

Time is running out! 2025 is the absolute final year to take advantage of the generous Inflation Reduction Act (IRA) tax credit for energy-efficient home improvements. This isn't just about buying; your Indow inserts must be installed by December 31, 2025, to be eligible. Given the time it takes to measure, order, and install, you need to act now to secure your savings. The final date to start your order and ensure the tax credit is November 7, 2025.

You can save 30% on the cost of energy-saving Indow window inserts with tax credits from the Inflation Reduction Act. With these tax credits, you can lower your tax bill by up to $1,200 by purchasing approved energy efficient window inserts - that's over $100 in savings on a standard size Indow window insert!

Indow's insulating window inserts qualify for this tax savings of up to $1,200/year on energy-efficient home improvements. This significant opportunity ends when the credit expires on December 31, 2025. Remember, to claim this credit, your inserts need to be installed within the tax year you're claiming them. Don't delay—the process from consultation to installation takes time, so get started today!

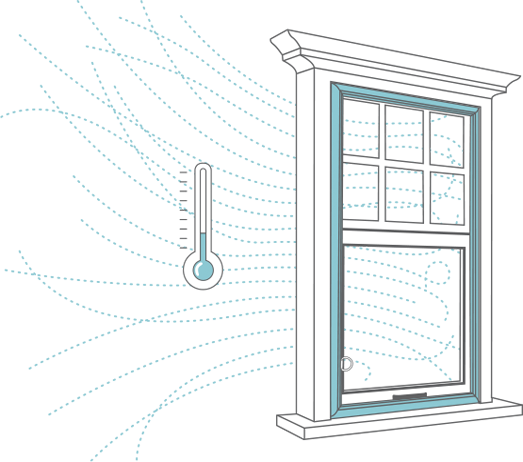

Improve the energy efficiency of your home, eliminate cold drafts in the winter, and keep your home cooler in the summer with our custom-made window inserts.

Indow customers save an average of 20% on heating & cooling bills and installation is a cinch - your inserts will slide right into place and can be easily removed when needed.

Learn more about how Indow inserts can improve your home's energy efficiency or talk to one of our expert Fit Specialists today!

To receive a customized estimate for your space or learn more about how Indow inserts can improve the comfort, quiet, & efficiency of your home, fill out the fields below.

Your Indow inserts are fully-backed by our Lifetime Warranty and Snug-Fit Guarantee. We'll guide you through every step of the purchase process and even send you a state-of-the-art laser measuring kit to ensure your inserts fit right - no matter the shape or size.

Bothered by noisy neighbors or street noise? In addition to lowering energy bills and increasing comfort, Indow window inserts reduces outside noise by at least 50%.

But, if noise is a major problem in your home, you can upgrade your purchase to our Acoustic Grade window inserts and enjoy up to 70% noise reduction.

You'll sleep better, feel better, enjoy your space more - and because our Acoustic Grade inserts are just as effective at improving energy efficiency - you can still save big with the IRA tax credits.

Indow is a certified manufacturer of "eligible building envelope components" (window inserts) that may qualify for the Inflation Reduction Act tax credit pursuant Section 25C of IRS Notice 2022-48.

To qualify for this credit, your window inserts must be installed in a dwelling unit located in the United States and the order must be shipped in the tax year you are claiming the credit for. This is critical: installation must be completed by December 31, 2025 to be eligible for the credit. $1,200 is the maximum allowable credit for all qualified energy efficiency improvements in a single tax year.

Due to the complexity and uniqueness of tax law, we recommend consulting a tax advisor if you are uncertain about your eligibility for this credit.

Indow has insulated more than 23,000 buildings - helping reduce carbon emissions by nearly 200,000 tons - and creating comfort across the US & Canada!

The indow window company and their staff are great Partners in battling the cold winter drafts coming through your windows and helps keep your home warm and cozy.. Wonderful company and great customer service..